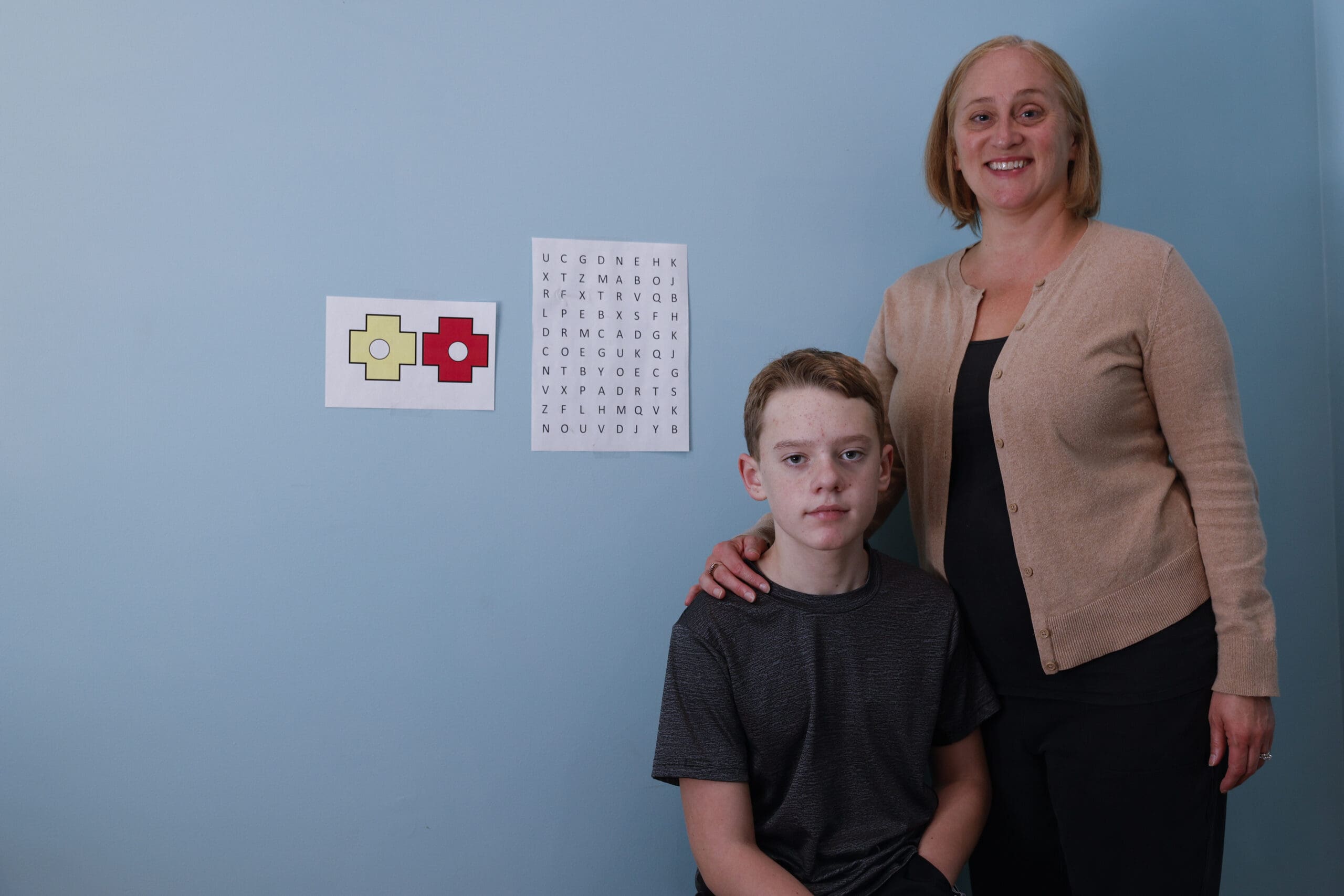

Provided by Sara Frank-Hepfer

With every news story about the latest Powerball jackpot, it’s only natural to wonder, “What would I do if I won the lottery?” Although your chances of hitting the jackpot may be slim, a financial windfall could well come your way through more ordinary means, such as the settlement of a lawsuit, a severance package, a family inheritance, or simply a larger-than-expected tax refund. Unfortunately, along with the obvious rewards, a windfall can be accompanied by plenty of potential problems.

When a large sum of money is thrust into their hands, otherwise smart people can make serious financial mistakes. In fact, as many as 70 percent of Americans who receive a windfall lose it all within a few years, according to the National Endowment for Financial Education. If you find yourself on the receiving end of a windfall-whether it’s millions of dollars or a few thousand-following the advice outlined here will help you make the most of your good fortune.

Before you do anything

In the initial rush of excitement, it may be tougher than you think not to make any quick decisions. Before deciding how to use your newfound funds, take a step back, think carefully about your situation, and assess all of your options. To avoid making choices you may regret later, keep these basic tips in mind:

o Stay grounded and realistic about the amount of money you have. Remember, drawing too much attention to yourself may attract friends or distant relatives who are more interested in getting handouts than in your personal well-being.

o Avoid hasty purchases on big-ticket items.

o Establish a budget to keep from spending too much. One rule of thumb is to avoid spending more than 5 percent of your new funds in the first year of your payment.

Know how much you really have. Oftentimes, recipients overvalue a windfall, failing to consider taxes and other factors. Some windfalls, such as insurance payouts, are tax-free. Lottery or severance payments may have taxes withheld before funds are paid to you, but you might need to set aside more money for taxes if the windfall pushes you into a higher tax bracket. Before visions of sports cars and mansions start to fill your head, be sure to put a real number on the money you have.

Don’t immediately quit your job. It’s also unwise to assume you can stop working. You’ll need to evaluate if you have enough money not only to replace your current income but to see you through retirement. Remember that, if you quit your job, you will stop earning income that contributes to social security and other retirement benefits.

Involve your advisor. As your financial advisor, we can guide you in the right direction and help you put your assets to best use. Working with your existing financial plan, we can strategically assess your options, taking into account tax considerations and your risk tolerance. We can also help you weigh the potential benefits of strategies such as trust funds and special types of life insurance.

Spending wisely

Once you’ve evaluated your new financial situation, consider these smart spending tips:

Set aside emergency savings. If you don’t already have a bank account or money market fund with enough to hold you over in case of a “rainy day,” creating one should be a top priority. Ideally, you’ll want to set aside sufficient funds to cover your expenses for 6-12 months (3-6 months at the least). Be sure to factor in all of your expenses, including your mortgage or rent, car payments, utilities, and groceries.

Pay off high-interest debt. If you have any debt, getting it out of the way is likely a wise move. High-interest debt, such as credit card balances and payday loans, can be particularly worthwhile to pay off in the short term; the return on any investment you might otherwise make with that money isn’t likely to offset the loss from high interest rates.

Evaluate your health and retirement plans. Here are a few options to consider:

o Maximize your employer’s retirement plan. If your windfall comes in the form of a bonus, it may be easy to transfer funds directly to your retirement account.

o Weigh the benefits of a Roth IRA. If your income level is too high, you can always contribute to a traditional IRA and convert. For more information, visit www.irs.gov/Retirement-Plans/Roth-IRAs.

o If you contribute to a health savings account (HSA), think about paying all of your health care costs out of pocket and letting your HSA grow tax-free.

Treat yourself a little. Clearly, it’s best to proceed with caution when making decisions regarding a financial windfall. At the same time, it doesn’t hurt to enjoy a bit of freedom with your newfound wealth. Perhaps you’d like to travel to a place you’ve never had the extra money to visit or treat the family to a fancy dinner and night out. A small indulgence could actually reduce any urge you might feel to spend the funds unwisely.

.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Sara Frank-Hepfer is a financial consultant located at Financial Technology, Inc., 1500 Abbot Road, Suite 150, East Lansing, MI, 48823. She offers securities as a Registered Representative of Commonwealth Financial Network®, Member FINRA/SIPC. She can be reached at (517) 351-8600 or at frank@financialtec.com.

© 2015 Commonwealth Financial Network®

This article was printed in the January 10, 2016 – January 23, 2016 edition.